AI & MACHINE LEARNING, WHITEPAPERS

Repost from Lucidworks

Generative AI (GenAI) has become an extremely hot topic in the first half of 2023. What interests us about GenAI is its potential in the realm of search. There is a lot of opportunity for both customer-focused applications as well as knowledge management solutions for employees. In other words, it can vastly improve the user search experience–and that gets us excited.

However, not every business thinks about search the way we do, and the hype around the technology is quickly outpacing its practical nature. That’s why we conducted the largest study of GenAI and the global business sentiment around it to get a better understanding of what decision-makers expect from the technology, their concerns, and their interests.

We did this by asking six thousand professionals who work in AI development and business leadership their thoughts.

Here are five of the biggest findings…

1. Most companies plan to increase AI investment

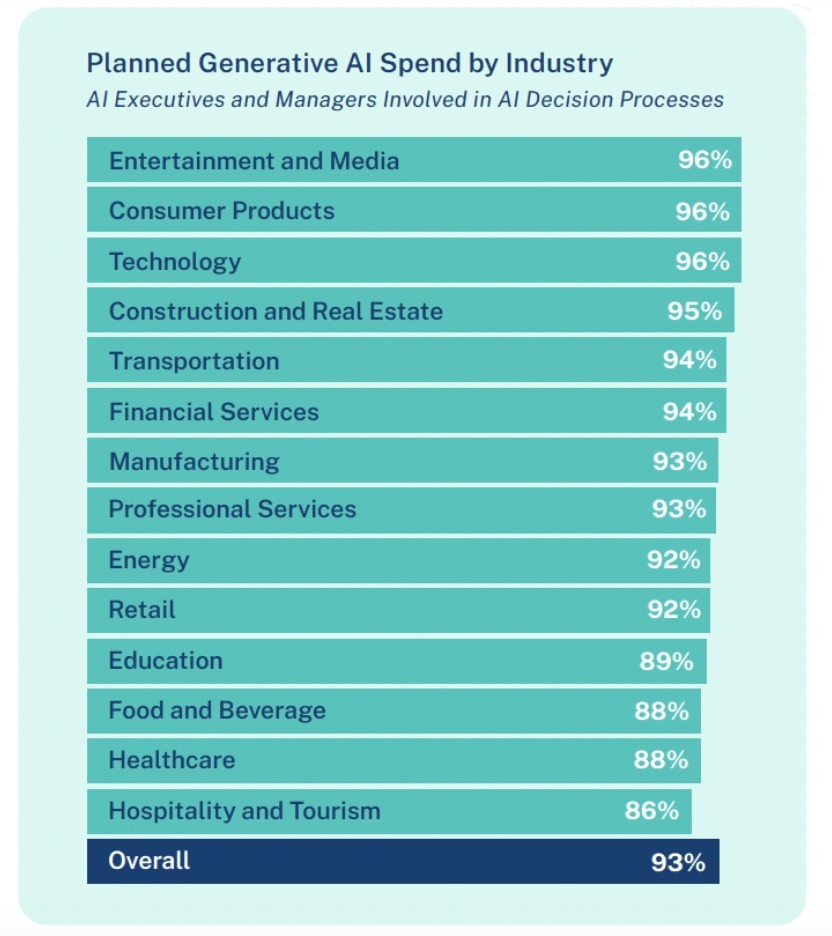

In the race to harness the power of GenAI, companies are gearing up for an investment surge, with a whopping 93% planning to increase their AI spending in the next twelve months. From a global perspective, China and India are leading the charge of primary decision-makers embracing this advancement, while the United States comes through slightly below the global average. Though the U.S. has been at the forefront of the innovation, the dip signals a hesitancy and need to remain vigilant for a competitive edge.

2. Investment is led by tech, consumer products, and construction/real estate industries

GenAI investment is looking promising in the industries of entertainment and media, consumer products, technology, and construction and real estate. Based on an analysis focused on executives and managers who hold primary decision-making roles related to AI spending, these top industries have recognized the potential of GenAI to revolutionize content creation, entertainment offerings, and customer experiences.

Conversely, the hospitality industry and food/beverage industry are emerging as laggards in GenAI investment. This is not necessarily a static fact, as more knowledge about the technology and its applications may lead to further exploration once use cases become more clear.

3. Tech and data science are the top functions

An interesting finding that our study has outlined is the widespread enthusiasm of GenAI technology among various business departments. Roughly 96% of executives and business managers involved in AI decision processes actively prioritize GenAI investments. This is not necessarily surprising, however it is closely followed by finance and accounting, and research or product development departments all planning to invest. Teams like this recognize the importance of AI in driving innovation, accelerating product development cycles, and enhancing the creative process of delivering cutting-edge solutions that evolve to the needs of consumers.

4. Most businesses are still early in adoption

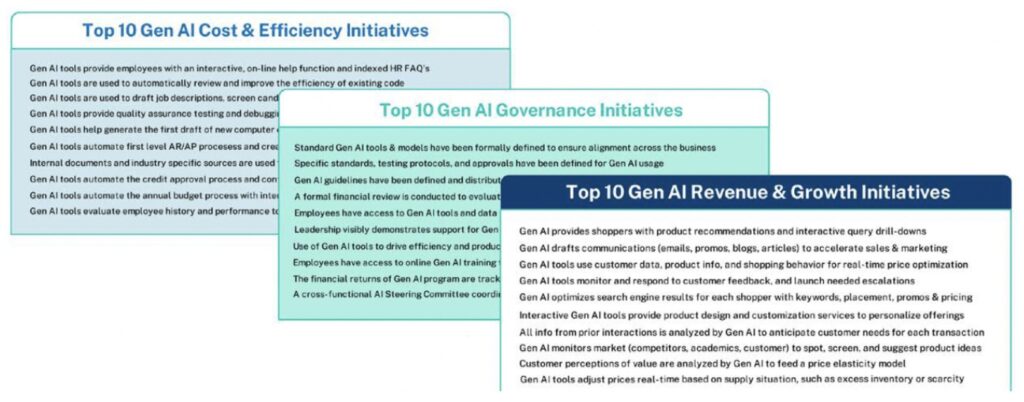

The hype is hot but the reality is that most businesses are still in the earliest stages of putting the technology to practice. Our study outlines eighty GenAI best practices, and the average company has launched a mere 7.5 initiatives, indicating that there is ample room for growth and opportunity. Of course, the technology sector leads the way on overall adoption with slightly above average best practices implemented (10.7), however retail is following close behind (7.7) with a lot of hunger to innovate.

5. Best practices have already emerged

Businesses should be aligning their AI initiatives with industry-specific best practices. By doing so, businesses can capitalize on the most effective approaches for their respective sectors, enhancing the likelihood of successful implementation and maximizing the benefits of the technology itself. In our benchmark study, we’ve plotted industries based on four distinct phases of progression along the GenAI road. This categorization enables companies to determine their level of maturity in AI adoption, and then further construct their roadmap to their own individual needs.

What does all of this mean for businesses who are interested in testing the waters? The short version is now is the time to understand the strategy and operational opportunity behind GenAI technology–and there’s a right and wrong way to do it.

These are only a handful of the takeaways of our benchmark study. Download the full report to get more insights on how businesses are approaching the world of GenAI and applying it to their own models.

CSS Commerce is a Lucidworks SI partner with a track record of excellence. Call us today to ask how Lucidworks can best work for you.

BY CHRIS COTTLE